Basic Income

As the pandemic of 2020 rages, a new Administration forms, and Congress lobs partisan volleys back and forth across that ever widening aisle on the Hill, we are at an inflection point of unprecedented gravity. Possibly not since the Civil War has the United States seemed so divided and likely to come apart. If ever a time called for fundamental change in our social contract as Americans, this is it.

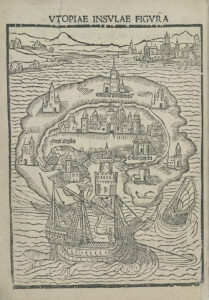

A lot of bright people looking at the problem from different perspectives — Thomas More here, Martin Luther King, Jr. here, the economist Milton Friedman here, former treasury secretary Robert Reich here, Andy Stern of SEIU here, the libertarian Charles Murray here, presidential candidate Andrew Yang here, entrepreneur Jack Dorsey here, and Pope Francis here — all have advocated for one or another form of universal basic income. The Pew Trusts are one of many organizations taking a serious look at the subject in the time of pandemic here.

Perhaps this is the time to consider a grand experiment. Every artist I know, most waiters and cooks, clerks, contractors, producers, bellhops, maids, many of the people who in the best of times are barely making a living, all of them today are out of work. They join the chronically unemployed in facing an uncertain and frightening future in this land of plenty.

We need to get money in their hands to provide them stability and kick start the economy. What would happen if those people at the bottom of the economic food chain had dependable income for a change? Enough to pay the rent, buy the food, keep the car running, arrange child care, make their tuition. Enough to cover the basics. Maybe even a dollar left over.

They would spend it, not horde it. The money would circulate. A basic tenet of capitalism would be in play. And, people could conduct their lives from a place of stability rather than fear, likely with more perspective about how to prepare for the future rather than merely trying to get through the day.

What would our response to the pandemic look like then? Could the litany of inequities it has exposed in our society be at least addressed if not completely mitigated? Would the anger, the anguish, the divisions in our social order be calmed by fair play and compassion as orienting principles?

Perhaps we’ll never know. The tax code itself would have to be changed to something simple and transparent. Everyone who is succeeding these days in raking in the dollars would have to pay a share of the costs. The vested interests of our economic system, not coincidentally the most successful among us, would have to yield some of the cherished privileges they’ve lobbied so successfully to acquire. The hue and cry of the defenders of the status quo would be deafening.

At least at first. Once we got past the knee-jerk responses about rewarding idleness, competition bringing out the best, redistribution of wealth as a third rail of enterprise, we might find a lot to like about the idea.

When the discussion is seriously engaged, there are any number of benefits that could be realized and the prospect of far less pain than we currently are suffering. What pain there would be conveniently accrues to those with the greatest resources, who are presumably best able to weather it. Also, the most likely to resist it. Who willingly gives up privilege?

There is nothing about basic income that compromises free enterprise and capitalism. Everybody is free to earn as much as they can. The wheels of commerce if anything will turn even more smoothly. More people will be able to pursue their aspirations in this land of opportunity.

But, of course, we have to pay for it. That could only be accomplished by a tax code that supports a social contract among all Americans rather than a system of winner take all and hide as much as you can in the process. It would require an emphasis on circulating money rather than — but not to the exclusion of — accumulating it.

When corporate titans like Apple, Google, and Microsoft sit on cash hordes of hundreds of billions of dollars — emphasis on “sit on” — and pay precious little taxes, we might question the concept of trickle down economics. When Warren Buffett freely admits his secretary pays a far greater percentage of her income in taxes than he does, we might wonder if there is any possible pretense of fairness in the system.

The pandemic that is raging through the world is stressing all our systems of support. It is showing, too, the weakest parts of our social infrastructure and where opportunities exist to strengthen it. Universal Basic Income may be an idea whose time has come.

credit: bl.uk

/

Sign me up please! I have books to write but can’t afford to stop working to write them.

I hear you, Jeff!